What do you Need to Know to Cover your Bases?

You probably know you have to be insured in order to drive, but you may be wondering exactly what you need. What is the bare minimum car insurance? How much will it cost you each month and per year? Liability auto insurance coverage is a must.

However, it’s not always enough. Understanding the difference between different types of auto insurance and why insurance companies might charge different rates can help you make an informed decision.

Read this article to learn more as we explain liability car insurance and how to buy auto insurance that’s best for you. Before we get started, use your ZIP code to get a free quote on liability auto insurance today to see how much you might pay.

What does Liability Auto Insurance Coverage Offer?

Getting into an accident is never fun. It’s definitely not intentional, which is why we call it an accident. Even if you consider yourself to be an exceptional driver with a crystal-clear driving record, you cannot always protect yourself from others who aren’t driving safely. Weather, traffic, kids, and even the radio can take your focus off the road if only for a second, leading to accidents.

This is precisely why liability auto insurance was created – to protect drivers in the case of an at-fault accident.

Liability car insurance will cover damage to another vehicle or personal property in an at-fault accident. In other words, if you slide on a patch of ice and hit another car, your liability insurance would cover the damage to the other injured party. Many states institute protections for the driver holding the liability insurance, protecting them from lawsuits and additional liability after the fact. The minimum liability limit varies based on state regulations and other factors.

While most drivers carry more comprehensive policies with coverage for their own car as well, liability coverage is critical.

Who Needs Basic Liability Car Insurance?

“Bare-bones” legal liability auto policies offer basic car insurance coverage required to drive in most U.S. states. So in short, everybody needs it, and everybody must meet “compulsory limits” whether you’re a business owner or an individual driver. Prices increase if driving is part of the professional services you offer (think Uber or Lyft).

What does Liability Protection Cover?

Even if you never get in an accident, it’s a type of social assurance. By taking your liability auto insurance coverage and issuing a license, the state allows you to drive a vehicle on state roads. By carrying liability insurance (and the requisite proof of insurance), you’re telling other drivers that if you’re at fault, they don’t have to worry about their auto damages and medical injuries being covered up to the legal requirements. Keep reading below to learn more about the types of insurance.

What is Bodily Injury Liability Insurance, and What Does it Cover?

Basic liability car insurance is a minimum driving requirement in almost all states. It can be broken down into two separate categories:

Bodily Injury Liability

If you are found at fault for an accident that results in a physical injury to the other party, bodily injury liability coverage will kick in. It provides coverage for the other party’s auto injury-related expenses up to the policy limits. This includes medical bills, rehabilitation costs, long-term care, funeral expenses, lost wages, pain and suffering, and related damages. Bodily Injury Liability may also pay for your legal defense if you are sued for an accident that results in bodily injury.

Property Damage Liability

If you are found at fault for an accident that damages another party’s property, property damage liability coverage will cover repairs up to the policy limit. Eligible property damage may include houses, fences, or cars, for example. Property Damage Liability may also pay for legal defense if you are sued for an accident that results in property damage.

If you are found at fault for a car accident, liability coverage will provide insurance coverage to the other driver to pay for property damage and bodily injury liability claims.

Liability coverage has a protective obligation to an injured person. Its goal is to settle the damage claims reasonably to avoid any harmful personal financial damage to an insured party.

Personal liability auto insurance covers individual drivers. If you drive for a living, though, professional liability insurance rates come into play. If you have a paid driver who gets in an accident, the legal liability coverage for the paid driver will be included as long as they are listed as a driver on your policy.

State Minimum Requirements dictate that Bodily Injury and Property Damage Liability go Hand-in-Hand

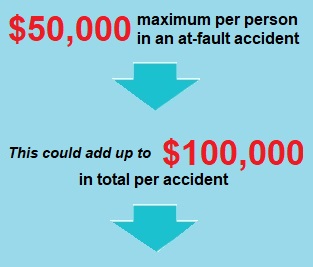

The two separate categories are listed under the liability section of a car insurance policy. But not so fast – basic bodily injury coverage may be further broken down into maximum payment amounts per person and per accident.

On the other hand, if you misjudge a turn late at night and run into a fence in a neighborhood, you will be held responsible for the damages. Your property damage liability insurance will provide up to $50,000 in coverage to pay for a broken fence, as well as any other damage you may have caused to the yard, mailbox, sidewalk, etc.

Liability coverage numbers may be depicted in their full value or shortened. You may have seen 50/100/50 liability or 50/100/50 car insurance. What does this mean?

In most policies, you will see liability coverage shown in three amounts for this reason:

50,000/100,000/50,000 or 50/100/50

BODILY INJURY PER PERSON/BODILY INJURY PER ACCIDENT/PROPERTY DAMAGE

What does liability insurance on a car cover?

To break it down for you, your auto liability coverage may pay out per injured person

if multiple people are injured. Another $50,000 will also be available for related property damage in an at-fault accident.

What are Liability Auto Insurance State Minimums?

ONCE AGAIN, LIABILITY STATE MINIMUM REQUIREMENTS WILL VARY GREATLY. HERE ARE SEVERAL EXAMPLES OF STATE LIABILITY LIMITS THROUGHOUT THE U.S., WHICH WE PULLED FROM THE INSURANCE INFORMATION INSTITUTE (III).

States have different liability car insurance requirements. Before you purchase liability car insurance, it is recommended that you learn your state’s requirements. Knowing that can help you make a better decision about how much coverage you want.

But let’s not forget about Michigan. . .

Michigan residents must also carry Property Protection Insurance or PPI within a liability car insurance policy. PPI is only available in the state of Michigan. Michigan has what is called a “No Fault Statute”, meaning drivers have to be prepared with no-fault insurance in Michigan. Under this statute, any accident within the state of Michigan is covered under a PPI value that every driver carries and accesses regardless of fault.

What Auto Insurance do you Need?

How much is enough?

You know, just liability car insurance will meet the requirements in your state. But do you need liability plus car insurance coverage that covers your damages? Some additional coverages include:

COLLISION INSURANCE

In the event of an accident, collision insurance compensates you for damage to your own vehicle.

PROPERTY DAMAGE

Many Insurance Agents will suggest starting at least $50,000 in property damage. This covers the repairs of the other person’s property.

BODILY INJURY PROTECTION

This compensates you for your own injury-related expenses, health care, work income lost, and child car expenses. If you have good health insurance or disability insurance, you may not need this.

Five Important Facts About Liability Auto Insurance

How well do you know your liability car insurance policy? What is covered under liability car insurance, and what isn’t? Here are five must-read facts about basic liability auto insurance:

LIABILITY AUTO INSURANCE WON’T COVER YOUR OWN VEHICLE

Remember, the entire purpose of liability car insurance is to provide you with financial protection and fulfill your legal obligation to pay for the other party’s injuries and/or property damage in an accident. Extended coverage with comprehensive and collision insurance will provide extra protection for your own damages.

YOU PROBABLY NEED MORE THAN BARE MINIMUM LIABILITY INSURANCE

While it may be tempting to pay as little as possible for liability car insurance, it will leave you vulnerable if you are injured or your vehicle is damaged in an accident. As mentioned above, full coverage auto insurance may cost more but will protect you physically and financially in an at-fault accident.

OLDER CARS MAY NOT NEED EXTRA COVERAGES

It may be to your advantage to only pay for liability coverage on an older vehicle when the cost of full coverage insurance exceeds 10 percent of the blue book value of your car. An older car may not benefit from comprehensive or collision coverage, depending on its value and the deductible, but liability is always necessary at the limits needed to protect an individual’s financial assets. If you have a $25,000 policy, cause $50,000 in damage, and have an investment property worth $50,000, that asset will be taken to pay the difference in damage and policy limit.

YOU CAN SET YOUR OWN LIABILITY COVERAGE LIMITS

Although it is required by law to meet basic state liability minimums in order to drive, you have the freedom to increase liability coverage limits at your discretion. Paying slightly more for liability insurance will provide extra financial protection in an accident.

CONSIDER UNINSURED/UNDERINSURED MOTORIST LIABILITY COVERAGE

In some states, Uninsured is mandatory. Underinsured coverage is optional. This liability insurance can cover your bodily injury and property damage in an accident with an uninsured or underinsured driver.

Liability vs. Full Coverage Car Insurance

SINCE LIABILITY CAR INSURANCE IS JUST A BARE MINIMUM REQUIREMENT BY LAW, THERE ARE CERTAIN AREAS THAT IT DOES NOT COVER, INCLUDING:

- Damage to your own vehicle in an at-fault accident.

- Your personal injury costs in an at-fault accident.

If you get into a serious accident and you are found at fault with minimum liability insurance, you may be held personally financially responsible for any damage expenses beyond the policy limit.

FOR THIS REASON, MANY INSURANCE AGENTS RECOMMEND UPGRADING A LIABILITY AUTO INSURANCE POLICY TO A FULL COVERAGE POLICY WITH:

- Collision Insurance – Covers vehicle damages sustained in an accident.

- Comprehensive Insurance – Covers vehicle damages outside of an accident, i.e. animal collision, fire, flood, etc.

- Medical Payments Coverage or Personal Injury Protection Insurance – Covers personal injury expenses in an accident.

In the Great Debate between Liability and Full Coverage Car Insurance, Which One Should you Choose?

The type of car insurance policy that you settle on will depend on your personal circumstances and your vehicle. If you’re looking for peace of mind, basic liability auto insurance isn’t going to cut it.

Liability insurance protects you against legal liability if you cause a car accident. Liability insurance will pay for bodily injury and property damage to the other party in an at-fault accident.

Full coverage car insurance is highly recommended if you don’t want to worry about paying for your own medical expenses and vehicle damages in an accident.

However, this still doesn’t explain how your vehicle can dictate your car insurance choice. If you have a brand-new car and are still paying on a loan or lease, the odds are that your lender may require you to carry full coverage car insurance in the loan contract terms. This requirement protects both you and the lender against any costly damages that may be incurred on your vehicle before it is paid off, no matter who or what causes a crash.

But as your car ages, it depreciates in value. Industry experts recommend abiding by the “Liability Golden Rule”: Once your car is eight years old or older, compare its blue book value against the cost of annual full coverage car insurance. If your annual collision and comprehensive coverage exceed 10 percent of the current value of your vehicle (as mentioned above), it may be time to drop full coverage and stick with liability instead.

Of course, there is always a catch. If you decide to choose liability coverage without any policy upgrades, it helps to have enough money in the bank to pay for your vehicle repair and/or replacement costs out-of-pocket. If you don’t feel that you can afford such major expenses in repairing or replacing a vehicle that has been totaled, stick with full coverage insurance until you have a larger sum in savings.

REMEMBER, FULL COVERAGE CAR INSURANCE WILL INCLUDE LIABILITY INSURANCE, PLUS SOME “EXTRAS” TO PROTECT YOU AS A DRIVER.

IF YOU CAUSE AN ACCIDENT WITH ONLY LIABILITY COVERAGE, YOU MAY NOT BE ABLE TO AFFORD TO HAVE YOUR VEHICLE REPAIRED OR REPLACED IF IT IS TOTALED

Also, you may be saddled with thousands of dollars in medical expenses that would have been covered with additional options such as Medical Payments.

How do I Keep Liability Coverage Affordable?

If you have taken the time to research liability insurance rates, you’ve probably discovered by now that car insurance certainly isn’t cheap.

While liability is less expensive than full coverage car insurance, it could cost you more than you anticipate, depending on where you live in the country.

If you live in Iowa, for example, you could pay as little as $1040 per year in car insurance. This is compared to a state like Rhode Island, where car insurance premiums may rise as high as $2298 per year. However, liability-only insurance costs may be lower than the above averages.

So what does the average liability car insurance cost? Take a look at this table to see a full list of the minimum requirements by state, along with average rates from the national association of insurance commissioners.

| States | Insurance Required in the State | Minimum Liability Limits Required | Average Annual Liability Insurance Rates | Average Monthly Liability Insurance Rates |

|---|---|---|---|---|

| North Dakota | BI & PD Liab, PIP, UM, UIM | 25/50/25 | $282.55 | $23.55 |

| South Dakota | BI & PD Liab, UM, UIM | 25/50/25 | $289.04 | $24.09 |

| Iowa | BI & PD Liab | 20/40/15 | $293.34 | $24.45 |

| Wyoming | BI & PD Liab | 25/50/20 | $323.38 | $26.95 |

| Maine | BI & PD Liab, UM, UIM, Medpay | 50/100/25 | $333.92 | $27.83 |

| Idaho | BI & PD Liab | 25/50/15 | $337.17 | $28.10 |

| Vermont | BI & PD Liab, UM, UIM | 25/50/10 | $340.98 | $28.42 |

| Kansas | BI & PD Liab, PIP | 25/50/25 | $342.33 | $28.53 |

| Nebraska | BI & PD Liab, UM, UIM | 25/50/25 | $349.07 | $29.09 |

| North Carolina | BI & PD Liab, UM, UIM | 30/60/25 | $357.59 | $29.80 |

| Wisconsin | BI & PD Liab, UM, Medpay | 25/50/10 | $359.84 | $29.99 |

| Indiana | BI & PD Liab | 25/50/25 | $372.44 | $31.04 |

| Alabama | BI & PD Liab | 25/50/25 | $372.57 | $31.05 |

| Ohio | BI & PD Liab | 25/50/25 | $376.16 | $31.35 |

| Arkansas | BI & PD Liab, PIP | 25/50/25 | $381.14 | $31.76 |

| Montana | BI & PD Liab | 25/50/20 | $387.77 | $32.31 |

| New Hampshire | FR only | 25/50/25 | $393.24 | $32.77 |

| Tennessee | BI & PD Liab | 25/50/15 | $397.73 | $33.14 |

| Missouri | BI & PD Liab, UM | 25/50/25 | $399.41 | $33.28 |

| Virginia | BI & PD Liab, UM, UIM | 25/50/20 | $413.12 | $34.43 |

| Illinois | BI & PD Liab, UM, UIM | 25/50/20 | $430.54 | $35.88 |

| Mississippi | BI & PD Liab | 25/50/25 | $437.38 | $36.45 |

| Minnesota | BI & PD Liab, PIP, UM, UIM | 30/60/10 | $439.58 | $36.63 |

| Oklahoma | BI & PD Liab | 25/50/25 | $441.57 | $36.80 |

| Hawaii | BI & PD Liab, PIP | 20/40/10 | $458.49 | $38.21 |

| New Mexico | BI & PD Liab | 25/50/10 | $462.21 | $38.52 |

| California | BI & PD Liab | 15/30/5 | $462.95 | $38.58 |

| Utah | BI & PD Liab, PIP | 25/65/15 | $471.26 | $39.27 |

| Colorado | BI & PD Liab | 25/50/15 | $477.10 | $39.76 |

| Arizona | BI & PD Liab | 15/30/10 | $488.59 | $40.72 |

| Georgia | BI & PD Liab | 25/50/25 | $490.64 | $40.89 |

| Pennsylvania | BI & PD Liab, PIP | 15/30/5 | $495.02 | $41.25 |

| South Carolina | BI & PD Liab, UM, UIM | 25/50/25 | $497.50 | $41.46 |

| Texas | BI & PD Liab, PIP | 30/60/25 | $498.44 | $41.54 |

| West Virginia | BI & PD Liab, UM, UIM | 25/50/25 | $501.44 | $41.79 |

| Kentucky | BI & PD Liab, PIP, UM, UIM | 25/50/25 | $518.91 | $43.24 |

| Alaska | BI & PD Liab | 50/100/25 | $547.34 | $45.61 |

| Oregon | BI & PD Liab, PIP, UM, UIM | 25/50/20 | $553.43 | $46.12 |

| Washington | BI & PD Liab | 25/50/10 | $568.92 | $47.41 |

| Massachusetts | BI & PD Liab, PIP | 20/40/5 | $587.75 | $48.98 |

| Maryland | BI & PD Liab, PIP, UM, UIM | 30/60/15 | $599.48 | $49.96 |

| District of Columbia | BI & PD Liab, UM | 25/50/10 | $628.09 | $52.34 |

| Connecticut | BI & PD Liab, UM, UIM | 25/50/20 | $633.95 | $52.83 |

| Nevada | BI & PD Liab | 25/50/20 | $647.07 | $53.92 |

| Rhode Island | BI & PD Liab | 25/50/25 | $720.06 | $60.01 |

| Michigan | BI & PD Liab, PIP | 20/40/10 | $722.04 | $60.17 |

| Louisiana | BI & PD Liab | 15/30/25 | $727.15 | $60.60 |

| Delaware | BI & PD Liab, PIP | 25/50/10 | $776.50 | $64.71 |

| New York | BI & PD Liab, PIP, UM, UIM | 25/50/10 | $784.98 | $65.42 |

| Florida | PD Liab, PIP | 10/20/10 | $845.05 | $70.42 |

| New Jersey | BI & PD Liab, PIP, UM, UIM | 15/30/5 | $865.55 | $72.13 |

As you can see, rates and coverage requirements can vary widely by state. For example, if you live in New Jersey, you can expect average rates for liability coverage to be three times more than liability coverage in North Dakota. As we’ve already noted, however, liability alone may not provide the coverage you need.

What can you do to Keep Car Insurance Costs Affordable in a More Expensive State?

First of all, it helps to understand that certain non-negotiable factors may dictate how much you pay in car insurance, as evidenced in the chart below:

Factors that Impact Auto Insurance Rates

| Factor Insurance Companies Consider when Adjusting Rates | Average Percent Affect on Auto Insurance Rates |

|---|---|

| Driving Record and Claim History | 35% |

| Age, Martial Status, and Gender | 25% |

| Car Make/Model | 18% |

| Insurance Carrier & Policy Options | 9% |

| Location | 8% |

| Credit | 3% |

| Occupation | 2% |

As you can see, static factors like age, marital status, and gender can contribute to 25 percent of your car insurance rates. The car make and model you drive is another major determining factor at a whopping 18 percent. And, of course, you can’t forget your driving and claim history, which impacts your car insurance rates by up to 35 percent.

One of the most effective ways to keep car insurance affordable is by buying only the amount of coverage that you need.

WHILE IT’S NEVER RECOMMENDED TO SKIMP ON CAR INSURANCE, OVERPAYING FOR COVERAGE CAN CREATE AN UNNECESSARY FINANCIAL BURDEN

You can discuss with your insurance agent one-on-one how much coverage is recommended based on personal factors, like the length of your daily commute, where you live, the type of car you drive, and your driving history.

Helpful Tips To Lower Your Auto Insurance Rates

- Compare three or more car insurance providers to determine competitive market rates.

- Ask for special discounts, such as student discounts or lower rates for combined policies.

- Consider continued driver’s education to improve a poor driving record.

- Upgrade your vehicle with discount-friendly safety equipment, like antitheft devices and antilock brakes.

- If you’re happy with your provider, stick with them for the long haul to earn discounts as a loyal customer.

The Bottom Line for Liability Auto Insurance

What is liability car coverage, and what does liability insurance cover for a car? Bodily injury and property damage up to your policy limits for the other driver if you’re found at fault for an accident. If you take away one thing from this article, we hope that it is the importance of meeting state minimum requirements for liability coverage.

DRIVING WITHOUT INSURANCE IS NEVER WORTH THE RISK

It can affect you and other insured drivers both financially and physically, especially if injuries aren’t covered in an accident. Once you meet liability requirements in your state, you can consider upgrading your policy with full coverage add-ons for complete protection every time you get behind the wheel.

Ready to get started? Use your ZIP code to get a free quote on liability auto insurance today!